Accounts Payable Days

A measure of how long it takes for the business to pay its creditors. A stable higher number of days is generally an indicator of good cash management. A longer time taken to pay creditors has a positive impact on Cash Flow. But an excessive lengthening in this ratio could indicate a problem with the sufficiency of working capital to pay creditors.

Also referred to as the accounts payable turnover is a measure of short-term liquidity that indicates the rate at which a company pays its suppliers (bills). The accounts payable turnover shows how many times a company pays off its accounts payable during a period of time – often one year. You may also hear the accounts payable turnover referred to as the creditor’s velocity or creditor’s turnover ratio.

Accounts payable turnover is used to evaluate a company’s financial status and creditworthiness. A low accounts payable turnover ratio indicates that a company has an inability to pay bills caused by a cash flow problem. On the flip-side, a high accounts payable turnover ratio indicates a level of cash flow that allows for suppliers to be paid in a timely manner.

Accounts Payable Turnover Ratio Formula

AP Turnover = Net Credit Purchases / Average Account Payable

If you are unable to determine Net Credit Purchases, you may use total net purchases instead.

The average accounts payable is determined by adding the beginning and ending inventory together and then divide by two

For example, let’s say at the beginning of the year accounts payable were $20,000 and $32,000 at the end of the year. And Net Credit Purchases (things purchased using credit) equaled $125,000

Average Accounts Payable = Beginning Inventory + Ending Inventory / 2

Step #1 AAP $25,000 = $20,000 + $30,000 = $50,000 / 2

AP Turnover = Net Credit Purchases / Average Account Payable

Step #2 AP Turnover 5 = $125,000 / $25,000

We can further break this down and determine the average number of days for account payables (meaning – on average, how many days it takes for the company to pay. We divide 365 by the Accounts Payable Turnover Ratio of 5 (as calculated above) = 73 days

The company is paying its, suppliers, 5 times a year or on average 73 days. So, what does this tell us? Without knowing how this compares to other child care businesses not much. Let’s say that in a normal economy, the average days payable is 49. When we compare of child care business with an average of days payable of 73 days our business does not compare well to industry averages.

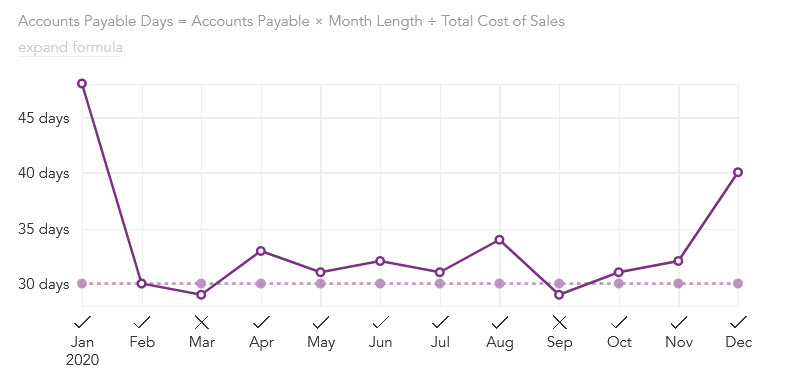

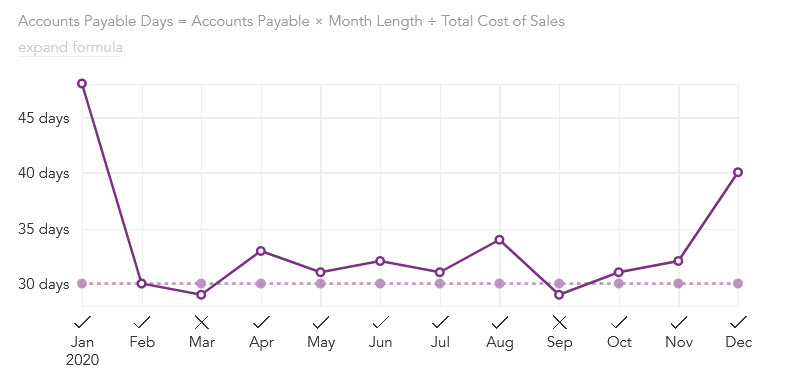

To share another example of a child care business below, where the accounts payable days are above the target of 30 days.

« Back to Glossary Index