- A child care-specific chart of accounts is a crucial financial tool, providing a clear overview of all business income and expenses.

- It simplifies compliance with financial regulations and reporting requirements, such as for a state-funded PreK program, by structuring financial data.

- A detailed chart aids effective budgeting and forecasting by using historical data to create realistic financial plans and allocate resources efficiently.

- It allows for better cost management by breaking down large expense categories, like salaries, into specific subcategories for improved financial control.

- This specialized tool streamlines accounting processes and ensures accurate financial data, which is vital for in-depth analysis and strategic decision-making.

Importance of Having a Specialized Child Care Accounting Chart of Accounts

Home » Accounting » Importance of Having a Specialized Child Care Accounting Chart of Accounts

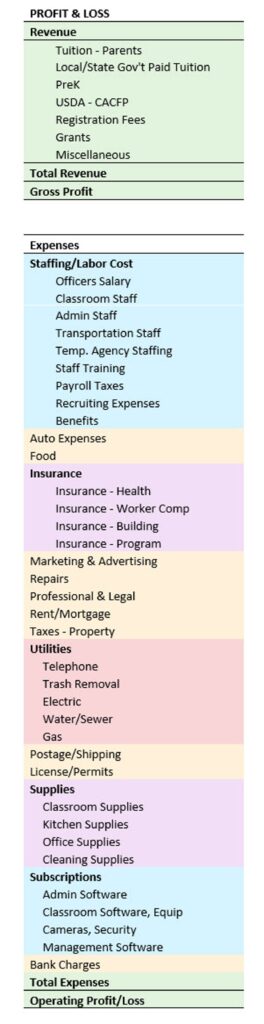

A child care business-specific accounting – chart of accounts is crucial for any child care owner to assist with financial management. This  comprehensive financial tool categorizes all financial transactions, providing a clear overview of the income and expenses of running a child care business. Using a general business chart of accounts makes reading financials more confusing and less helpful when trying to understand and analyze all sources of income and expenses – and impedes sound financial business decisions.

comprehensive financial tool categorizes all financial transactions, providing a clear overview of the income and expenses of running a child care business. Using a general business chart of accounts makes reading financials more confusing and less helpful when trying to understand and analyze all sources of income and expenses – and impedes sound financial business decisions.

A specific chart of accounts that provides greater detail about specific program income and expenses is essential for financial health and program sustainability. For instance, being able to tell precisely the tuition income and expenses associated with offering a state-funded PreK program can help determine its profitability or loss of income. Child care owners often only “guess” or “guesstimate” if they made any money last month or last year offering the state-funded PreK program. This often leads to multiple years of ongoing financial losses from some programs.

Child care providers must comply with various financial regulations and reporting requirements. A well-organized chart of accounts simplifies adhering to these regulations by providing a structured way to record and report financial data. This can help prepare for audits and meet the reporting standards set by licensing and program-specific requirements. Using the state-funded PreK program example, these programs often require the child care business to submit detailed reports about wages paid to lead, assistant, and substitute teachers, employee benefits, classroom supplies purchased, and associated costs. These things can be tracked using a well-designed chart of accounts. Otherwise, child care owners will spend needless hours compiling receipts and documentation to meet program reporting requirements. If the business fails to provide accurate documentation, it may not be allowed to participate in the program next year.

Generating financial reports becomes straightforward with a comprehensive chart of accounts. These reports provide valuable insights into the financial health of the child care business, highlighting areas of profitability and potential cost-saving opportunities.

Effective budgeting and forecasting are essential for the sustainability of a child care business. A detailed chart of accounts for child care-specific purposes aids in creating realistic budgets by providing detailed historical financial data and trends. This allows for more accurate future income and expense forecasting, facilitating better financial planning and resource allocation.

A child care-specific chart of accounts helps identify and manage specific costs by categorizing them appropriately. This enables child care providers to identify areas where expenses can be reduced or optimized, ultimately improving the facility’s financial efficiency. For instance, salaries and wages are often the most significant expenses in a child care business. It is essential not to have one large category for salaries and wages. Labor costs can be better managed by breaking this large expense category into subcategories. For instance:

Salaries and Wages

Salaries and Wages

Officers’ Salaries and Wages

Teaching Staff

Floaters

Kitchen Staff

Administrative Staff

Transportation Staff

Janitorial Staff

Staffing Agency Staff

This detailed breakdown of labor costs can be very helpful when trying to control labor costs – an ongoing – daily challenge in every child care business.

A comprehensive chart of accounts streamlines the accounting processes by providing a clear framework for recording financial transactions. This reduces the complexity of bookkeeping and accounting tasks, saving time and effort for the child care owner. It also minimizes the chances of errors, ensuring the accuracy and reliability of financial data. Lumping expenses into large categories does not provide the structure to ensure that next month or next year, the same expenses are lumped into the same large category as before. For instance, putting the cost of paper products used to serve food in food cost one month, and classroom supplies the next month decreases the accuracy and reliability of the financial data – and the ability to make sound financial decisions based on the data.

Financial analysis is vital for the growth and development of any business, including child care services. A detailed chart of accounts allows for in-depth financial analysis, enabling owners to understand their financial performance better. It helps identify trends, assess financial strengths and weaknesses, and make strategic decisions to enhance the facility’s overall performance.

A child care-specific accounting chart of accounts is essential. It is an essential tool that enhances financial management and decision-making. Review the sample chart of accounts and develop a chart of accounts specific to your child care business and the programs offered. Relevant categories and subcategories color-coded work great. But don’t go too crazy and create hundreds of categories and subcategories – just relevant, meaningful ones. Should you do your accounting in QuickBooks, Zero, or another accounting program, it is usually very easy to import or manually set up the chart of accounts and reassign expenses to each new category or subcategory. If you work with a bookkeeper or accountant – even better – they will be happy to assist you in implementing the new chart of accounts. Once in place, it will make both their and your job easier.