As a childcare business owner, one of the most important numbers you can understand is your childcare business’s break-even point—enrollment break-even, gross revenue break-even, and classroom break-even.

The “Break-even point” refers to the amount of sales—products or services a business must sell to cover all costs. Applying this to childcare, the break-even point would be the total tuition (gross revenue) needed to cover all costs. Break-even can also be the number of children enrolled to break even or cover all business costs. And, taken a step further, the total number of children needed to break-even in each classroom.

Of course, the break-even point means—well, breaking even—covering all costs but not making any profit. Without profits, it isn’t easy to sustain operations for very long.

Benefits of Break-Even Analysis

There are numerous benefits from Break-Even Analysis (calculating the break-even point) for various aspects of your childcare business. Let’s look at six critical benefits of break-even analysis.

Break-even and the ability to produce a profit begin with charging the correct tuition rates—not just for some age groups or programs, but for all age groups and programs. Too often in childcare, we find childcare businesses whose tuition rates do not result in breaking even, much less generate profits. Knowing the break-even for each age group or program is essential for setting tuition rates – breaking even – and achieving a level of profit that creates a financially healthy, long-term, sustainable business.

for some age groups or programs, but for all age groups and programs. Too often in childcare, we find childcare businesses whose tuition rates do not result in breaking even, much less generate profits. Knowing the break-even for each age group or program is essential for setting tuition rates – breaking even – and achieving a level of profit that creates a financially healthy, long-term, sustainable business.

The break-even analysis helps ensure that no business expenses are overlooked. Business owners who attempt to do a quick calculation risk overlooking fixed or variable expenses essential to operations. Not including all expenses results in a lower break-even point than accurate. A more thorough review of all expenses helps ensure that the actual costs—all operational expenses—are included in calculating the break-even point.

The break-even analysis helps ensure that no business expenses are overlooked. Business owners who attempt to do a quick calculation risk overlooking fixed or variable expenses essential to operations. Not including all expenses results in a lower break-even point than accurate. A more thorough review of all expenses helps ensure that the actual costs—all operational expenses—are included in calculating the break-even point.

Knowing the break-even enrollment (tuition revenue) needed for your childcare business and each classroom or program provides the essential financial information to establish tuition rates and set realistic enrollment goals and revenue targets. In addition, the ability to link performance to the most appropriate Key Performance Indicators (KPIs), both financial and non-financial. For instance, knowing the average daily enrollment needed to break even in the Two’s Classroom allows you to set KPIs linking to inquiries, tours, and conversion to enrollment for your administrative team.

Knowing the break-even enrollment (tuition revenue) needed for your childcare business and each classroom or program provides the essential financial information to establish tuition rates and set realistic enrollment goals and revenue targets. In addition, the ability to link performance to the most appropriate Key Performance Indicators (KPIs), both financial and non-financial. For instance, knowing the average daily enrollment needed to break even in the Two’s Classroom allows you to set KPIs linking to inquiries, tours, and conversion to enrollment for your administrative team.

Financial numbers are essential to all the information a childcare owner must consider when making business decisions. Unfortunately, decision-making in childcare does not include the level of financial analysis needed to ensure that accurate business decisions are made that will result in both a short-term and long-term positive impact on the childcare business.

Financial numbers are essential to all the information a childcare owner must consider when making business decisions. Unfortunately, decision-making in childcare does not include the level of financial analysis needed to ensure that accurate business decisions are made that will result in both a short-term and long-term positive impact on the childcare business.

An inaccurate calculation of the break-even point will lead to the business not reaching break-even, resulting in financial losses. Most childcare businesses can absorb small financial losses in some age groups or programs for a short time. However, ongoing significant financial losses in multiple age groups or programs can quickly lead to financial instability. Financial instability impacts the ability to deliver high-quality programs and ongoing business operations.

An inaccurate calculation of the break-even point will lead to the business not reaching break-even, resulting in financial losses. Most childcare businesses can absorb small financial losses in some age groups or programs for a short time. However, ongoing significant financial losses in multiple age groups or programs can quickly lead to financial instability. Financial instability impacts the ability to deliver high-quality programs and ongoing business operations.

Break-even analysis helps to create business profits and cash flow. The ability to obtain financing requires the childcare business to generate a healthy profit level and cash flow needed to meet short-term financing obligations – pay the bills. As well as enough additional cash flow to provide for improvements, major repairs, and other capital expenditures, such as replacing play structures, repaving the parking lot, and buying new classroom furniture when necessary. Should you seek to expand or obtain an outside investor or loan, investor interest and ability to obtain a loan will be limited without good financial business performance.

Break-even analysis helps to create business profits and cash flow. The ability to obtain financing requires the childcare business to generate a healthy profit level and cash flow needed to meet short-term financing obligations – pay the bills. As well as enough additional cash flow to provide for improvements, major repairs, and other capital expenditures, such as replacing play structures, repaving the parking lot, and buying new classroom furniture when necessary. Should you seek to expand or obtain an outside investor or loan, investor interest and ability to obtain a loan will be limited without good financial business performance.

Calculating Your Break-Even Point

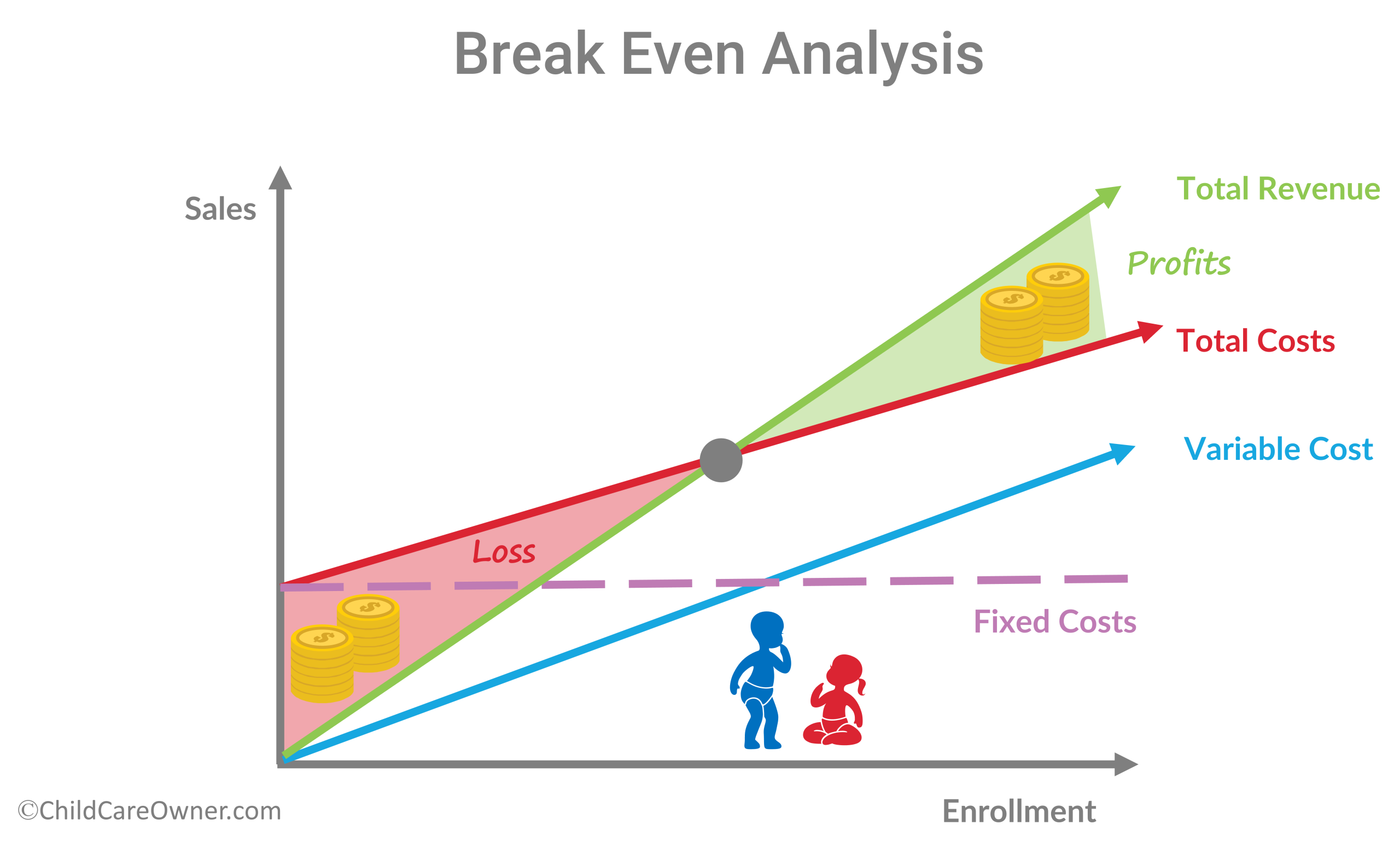

The graph illustrates that the break-even calculation includes fixed costs, variable costs, and the price charged for a product or service.

Fixed Costs ÷ (Price – Variable Costs) = Break-Even in Units

Fixed Costs are constant expenses, such as your facility rent or mortgage. Variable costs, on the other hand, are expenses that vary, like labor costs and vehicle fuel.

Fixed Costs ÷ (Price – Variable Costs) = Break-Even in Units

Fixed Costs ÷ (Total Tuition – Variable Costs) = Break-Even Enrollment

Another Simple Break-Even Calculation

Total Monthly Expenses ÷ 4.33 (Weeks) = Weekly Break-Even Revenue

You would also want to calculate the enrollment needed to break- even. For Example:

$100,000 (operating expenses) ÷ $900.00 (average tuition rate) = 111.11 Enrollment

To break even, your daily enrollment must be approximately 111 children. With an enrollment of 111, you would not lose money but would not make a profit, which is, of course, the goal of a business.

The break-even point for each classroom, age group, or program can (and should) be calculated using the same formula, using associated costs and tuition rates.

Calculating your break-even at least annually can be an excellent way to ensure tuition rates and total enrollment cover all costs. Enrollment levels necessary to break even and enrollment needed to achieve the desired level of profits should be tracked and included as an essential part of the financial management of your childcare business.